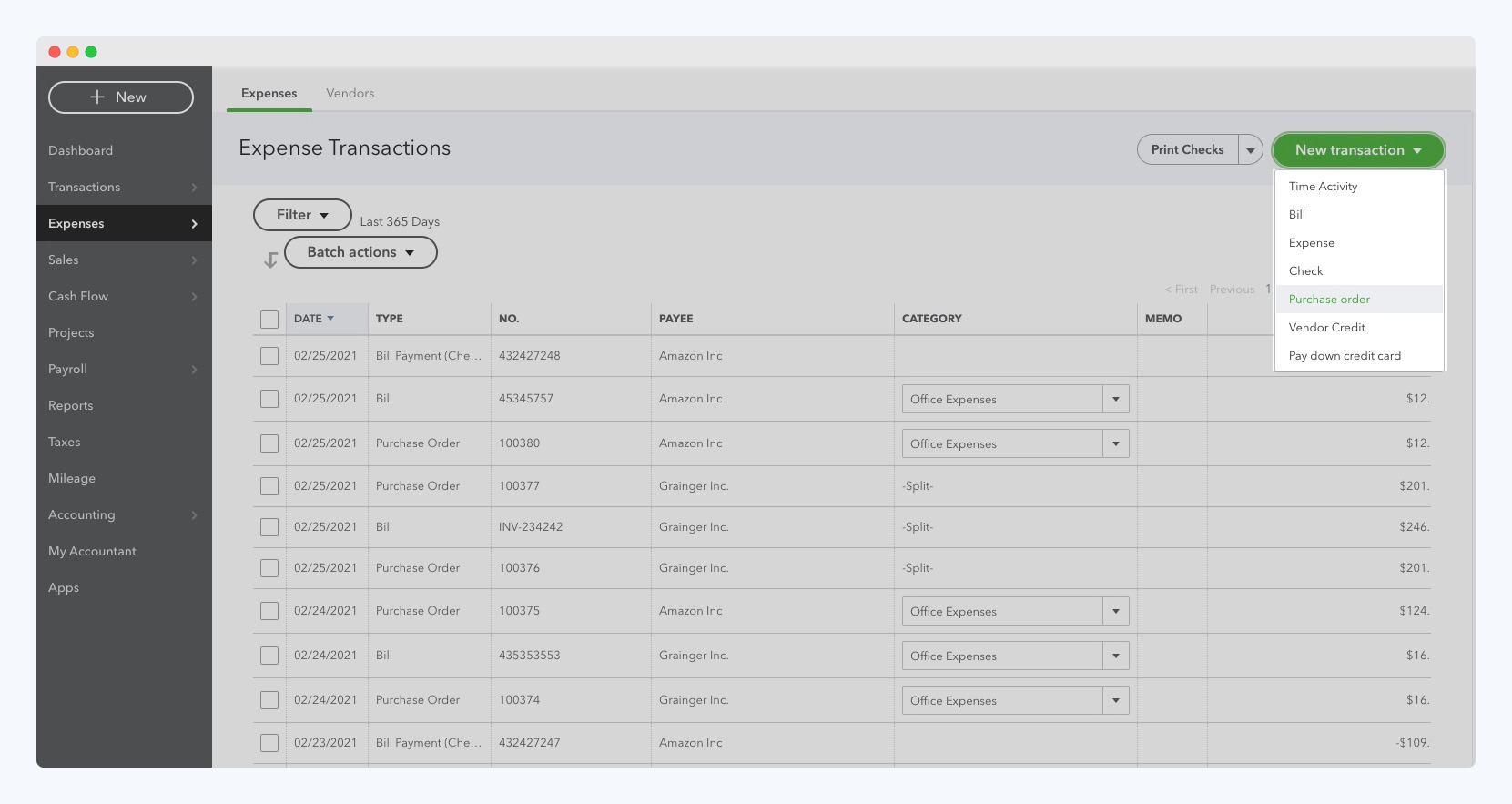

Then, when you get the purchase invoice in the future you will still be able to capture the correct cost and apply that prepayment to the vendor bill. The above steps will allow you to prepay your vendor for a PO. To Pay now reflects $2,000. From here you can pay the remaining balance.

That window will close and now the Pay Bills window will reflect the remaining balance. When you click Set Credits a new window will appear which you can select the credit and how much you want to use towards this invoice. When you click on the bill to pay it, QuickBooks will tell you there are available credits to apply to this bill. To view and apply the credits, click Set Credits.Ĥ. In QuickBooks, go to to Vendors> Pay Bills. After syncing the purchase invoice to QuickBooks it can be paid. Once we create the purchase invoice in Acctivate you will need to run a sync so that it can be paid in QuickBooks.ģ. Entering the purchase invoice into Acctivate ensures Acctivate captures the correct costs. However, since we prepaid $2,000, we will only have an outstanding balance of $2,000.

#Quickbooks utility purchase order manager full#

When you receive the bill from your vendor you will enter the full amount of the bill into Acctivate. This payment will be applied against the purchase invoice later.Ģ. In this scenario we are making a 50% payment of $2,000 to the vendor. This will create a check that can be sent to your vendor today. You must set the Account to be Accounts Payable.

0 kommentar(er)

0 kommentar(er)